W 4 Single 2 Allowances

- 2 Allowances W 4

- W 4 Single 2 Allowances Claiming

- W 4 Single 2 Allowances Single

- W 4 Allowances Single 2 Jobs

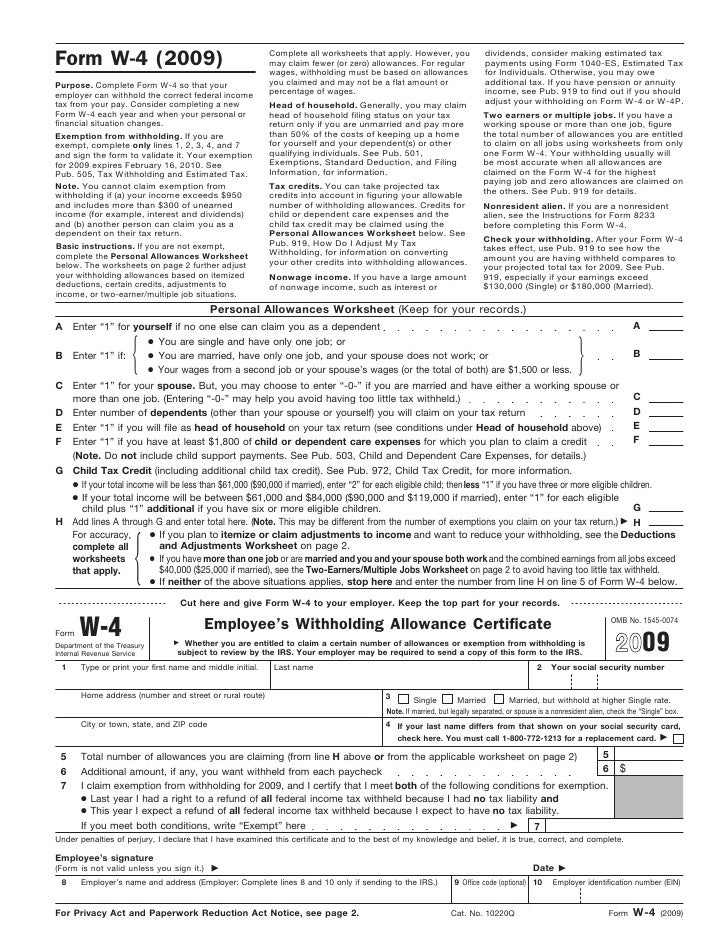

Prior to 2020, one of the biggest things you could do to affect the size of your paycheck was to adjust the number of allowances claimed on your W-4. The ideal number of allowances for you would depend on your individual situation, but now that the allowances section of the W-4 has been eliminated, filling out the form has become somewhat streamlined. We’ll discuss how allowances worked, and what has replaced them on the W-4. Finally, note that how you approach tax withholding and your W-4 depends on your individual situation and the particulars of your financial plan.

2 Allowances W 4

What You Should Know About Tax Withholding

To understand how allowances worked, it helps to first understand the concept of tax withholding. Whenever you get paid, your employer removes, or withholds, a certain amount of money from your paycheck. This withholding covers your taxes, so that instead of paying your taxes with one lump sum during tax season, you pay them gradually throughout the year. Employers in every state must withhold money for federal income taxes. Some states, cities and other municipal governments also require tax withholding.

2020 W-4 SAMPLE - claiming 'single'.pdf This sample document provides instructions on how to complete 2020 W-4 federal tax withholding certificate if an employee has evaluated their tax situation and determined that claiming 'single' is appropriate for their situation. The redesigned W-4 doesn't allow you to claim allowances. Instead, you're guided through a step-by-step process that calculates your withholding amount based on your current financial situation.

Withholding is also necessary for pensioners and individuals with other earnings, such as from gambling, bonuses or commissions. If you’re a business owner, independent contractor or otherwise self-employed, you will need to make sure you withhold taxes yourself. You can do this by paying estimated taxes.

Exactly how much your employer withholds will depend largely on how much money you make and how you fill out your W-4. While you used to be able to claim allowances, your withholding is now affected by your claimed dependents, if your spouse works or if you have multiple jobs. You can also list other adjustments, such as deductions and other withholding.

When you fill out your W-4, you are telling your employer how much to withhold from your pay. That’s why you need to fill out a new W-4 anytime you start a new job or experience a big life change like a marriage or the adoption of a child.

What Were Tax Allowances?

W 4 Single 2 Allowances Claiming

A withholding allowance was like an exemption from paying a certain amount of income tax. So when you claimed an allowance, you would essentially be telling your employer (and the government) that you qualified not to pay a certain amount of tax. If you were to have claimed zero allowances, your employer would have withheld the maximum amount possible.

If you didn’t claim enough allowances, you overpaid your taxes throughout the year and ended up with a tax refund come tax season. If you claimed too many allowances, you probably ended up owing the IRS money.

W 4 Single 2 Allowances Single

How Do I Affect Withholding Now?

W 4 Allowances Single 2 Jobs

Since the 2020 W-4 is far simpler than it has been in the past, it might seem harder to change your total withholding. The loss of allowances on the form might seem especially irksome, but not to worry. There are still plenty of ways to affect your withholding.

First, it’s important to fill out the multiple jobs or working spouse section using the worksheet on the third page of the W-4 so that the IRS has a proper record of how much money total you bring in. The total number of dependents you claim also has a significant effect on your total withholding, so make sure you claim the correct number of dependents.

Section 4 of the W-4 is a bit more open ended. Here you’ll be able to state other income and list your deductions, which can be used to reduce your withholding. Use the worksheet on page 3 of the W-4 to figure out your deductions. Finally, you can also use the extra withholding section to make your total withholding as precise as possible.

If you have a complex tax situation, it may be wise to work with a financial advisor who specializes in tax issues.

Claiming an Exemption From Withholding

If the IRS refunded you last year for all of the federal income tax that was withheld, and if you expect that to happen again this year, you can claim exemption from withholding. You cannot claim exemption from withholding if either one of the following is true:

- Another person can claim you as a dependent

- Your income exceeds $1,000 and includes more than $350 of unearned income, such as interest or dividends

Keep in mind that this exemption only applies to federal income tax. You still need to pay the FICA taxes for Social Security and Medicare.

Fine-Tuning Your Withholding

You can claim deductions and extra withholding as you so please. Taking an estimated or inaccurate amount would mean you overpay or underpay your taxes, but you’re allowed to do it. You may want to claim different amounts to change the size of your paychecks. This is a personal choice that helps you plan your budget throughout the year.

At the same time, you can submit a new W-4 at any time during the year. So if you decide that you want larger or smaller paychecks, you can submit a new W-4 to your employer with a different number of deductions or withholdings.

The Takeaway

Tax allowances were an important part of helping people reduce or increase the size of their paychecks. While they don’t exist on the W-4 anymore, its still very possible to effect the size of your paychecks by claiming additional withholding or deductions. Less withholding also means a bigger paycheck. It’s important to claim the right amount of deductions so that you can have as much money in-hand throughout the year without owing too much come tax season.

If you’re concerned about the amount your employer withholds, you can also refer to the withholding calculator provided by the IRS. Don’t forget that you can update your W-4 at any time. Simply fill out a new form and give it to your employer.

Next Steps

- Many financial advisors are tax experts and can help you understand how taxes impact your financial plan. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

- You’ll save time (and stress!) if you gather and organize all the supporting documents required to file your taxes. This means your W-2 or 1099s, student loan interest information, and a slew of other documents, depending on your financial situation. You might also use our tax calculator to get an estimate of what you’ll pay in income taxes.

Photo credit: ©iStock.com/vgajic, ©iStock.com/nandyphotos, ©iStock.com/Steve Debenport